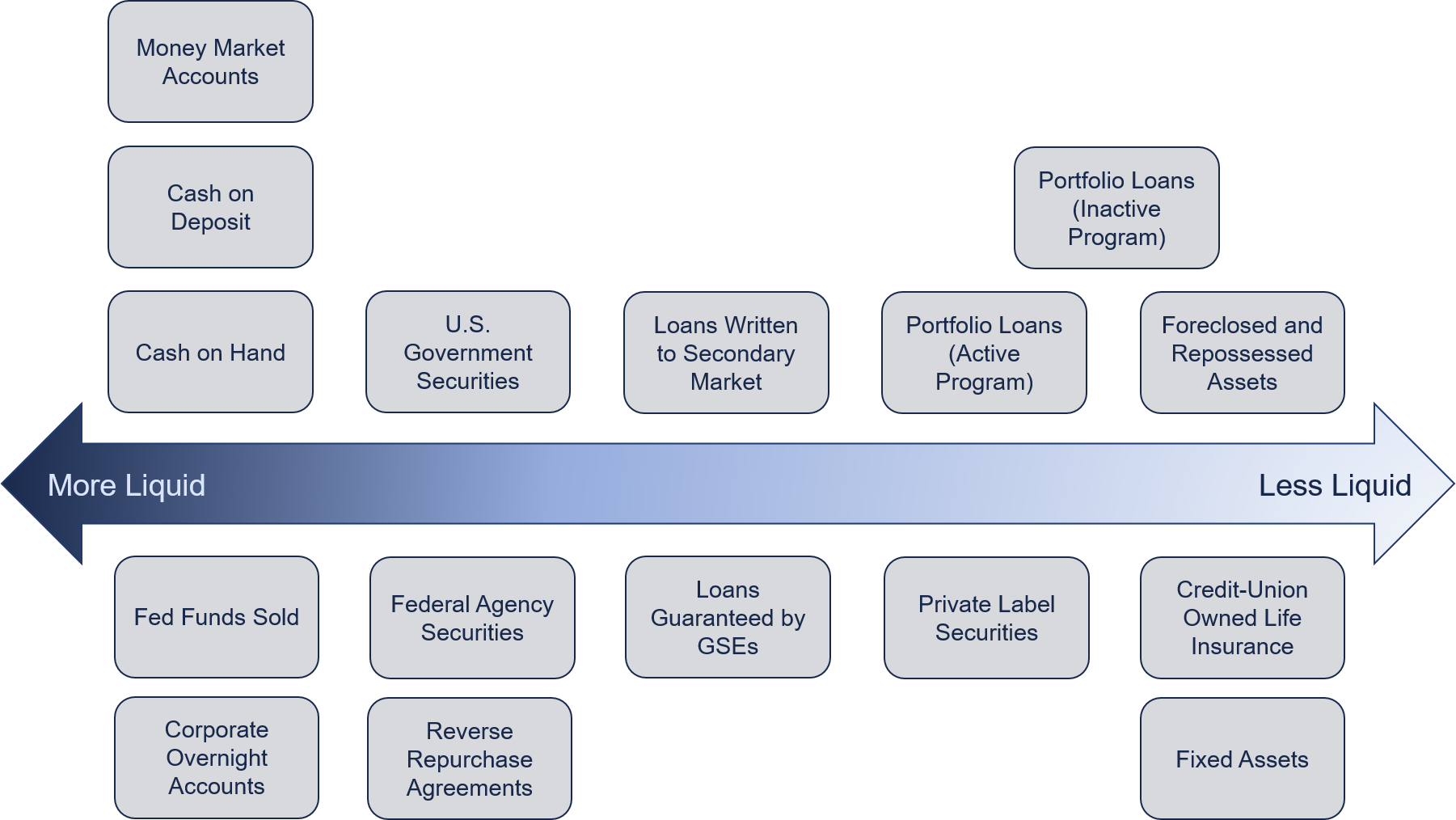

Asset-based liquidity sources include cash, loans, and investments. In evaluating asset-based liquidity, asset types that are easily and quickly sold (such as government securities) are considered more liquid and less likely to incur a loss due to existing market conditions. A balance sheet containing a greater proportion of more liquid assets exhibits less liquidity risk.

The following graphic illustrates a relative liquidity ranking associated to each asset type dimensioned from most to least liquid.

Cash

Cash is the most liquid asset-based source and carries no liquidity risk. Cash assets are comprised of:

-

Cash on hand

-

Funds in transactional accounts

-

Corporate accounts

-

Overnight accounts

-

Settlement accounts

A credit union can liquidate overnight deposits immediately and without loss of principal.

Loans

Loans typically represent the largest category of assets on a credit union’s balance sheet, and can provide liquidity through:

-

Repayment or amortization—As members repay their loans, credit unions receive periodic payments of principal and interest. Shorter duration loans—such as auto loans—will pay down principal quicker than longer duration loans—such as fixed mortgages—and exhibit lower cash flow volatility from changes in interest rates.

-

Sales—Credit unions can sell any loan held in their portfolio, including loans they originate, to generate cash. A credit union may originate loans with the express intent to sell at origination. By writing mortgage loans to secondary market standards, a credit union can quickly sell these loans to GNMA, FHLMC, FNMA or other financial institutions.

-

Participations—Credit unions can either buy or sell participations in high-balance loans or pools of loans, which may take several weeks or more to complete the sale.

-

Pledging as collateral—A credit union can pledge its loan portfolio as collateral to secure borrowing from external sources. External sources may include:

-

FHLBs

-

Correspondent financial institutions

-

Federal Reserve Discount Window1

-

NCUA’s CLF

-

For more information, see NCUA regulation part 725, National Credit Union Administration Central Liquidity Facility.

Investments

A credit union’s investment portfolio can provide a safe and ready source of liquidity and augment core earnings. Credit unions use investments to generate liquidity through maturing securities, selling securities for cash, or by using securities as collateral for borrowings.

A prudent credit union manages its investment portfolio as a component of the overall cash flow management by matching expected investment cash flows—for example maturities, periodic interest payments, or principal pay downs on amortizing securities—against anticipated funding needs—for example, expected loan growth, share withdrawals, or repayment of borrowings. A high concentration of long-duration investments can expose a credit union to liquidity risk during periods of market volatility.

For example, if interest rates rise or credit spreads widen, investment values (especially for longer duration securities) may decline and can result in material losses if the credit union needs to sell them to raise cash. Declining investment values can also inhibit the credit union’s ability to raise liquidity through borrowing arrangements when investments serve as collateral.

For accounting purposes, GAAP requires credit unions to classify investments as HTM, AFS, or trading. The classification of an investment does not impair its marketability, but the classification may impact the credit union’s ability to sell investments if not recorded as trading or AFS.

Thus, if a credit union carries a significant volume of HTM investments and needs additional liquidity, the credit union may not be able sell any HTM investments without the accounting consequences. HTM securities are those that the credit union has the intent and ability to hold until maturity. If a credit union regularly sells HTM securities or transfers HTM securities to AFS, the external auditor may require the credit union to reclassify all HTM securities as AFS. See the Investments chapter of the Examiner's Guide for more information.

Last updated August 30, 2021